Introduction

In the world of finance, stability is often considered a hallmark of economic progress. However, the financial markets are known to occasionally exhibit unexpected and tumultuous behavior that can have far-reaching consequences. One such phenomenon has recently captured the attention of economists, investors, and financial analysts: the unprecedented sell-off of US bonds. This unexpected event has sent shockwaves through the global financial landscape, raising concerns and prompting discussions about its underlying causes and potential implications.

Understanding US Bonds

Before delving into the current sell-off, it’s important to grasp the fundamentals of US bonds. A bond is essentially a debt security that an investor purchases from a government or a corporation. When you buy a bond, you’re lending money to the issuer in exchange for periodic interest payments and the promise of the principal amount’s return when the bond matures. US Treasury bonds, backed by the US government, are considered one of the safest investment options in the world due to the perceived low risk of default.

The Unprecedented Sell-Off

In recent times, the financial world has witnessed a unique and unexpected event: an unprecedented sell-off of US bonds. This has resulted in a noticeable increase in bond yields, particularly in the longer-dated maturities. Bond yields move inversely to bond prices, meaning that as yields rise, bond prices fall. This sell-off has raised eyebrows due to its speed and magnitude, catching both experts and investors off guard.

Factors Behind the Sell-Off

Several interrelated factors have contributed to the unprecedented sell-off of US bonds:

Inflation Concerns: One of the primary drivers of the sell-off is concerns about inflation. As economies recover from the COVID-19 pandemic, there are worries that the massive monetary stimulus measures implemented by governments and central banks might lead to higher inflation. Investors are demanding higher yields to compensate for the eroding purchasing power of fixed-income assets in an inflationary environment.

Monetary Policy Shifts: Central banks play a crucial role in influencing bond yields. The sell-off coincided with signals from central banks, including the US Federal Reserve, that they might begin tapering their bond-buying programs and eventually raise interest rates to combat rising inflation. These signals prompted investors to anticipate higher yields in the future, leading to a rush to sell bonds before yields increased further.

Global Economic Dynamics: Economic recovery is not uniform across all regions. As some economies rebound faster than others, there is a disparity in monetary policy trajectories. This divergence can impact global bond markets, as investors seek higher returns in regions where central banks are more likely to raise rates sooner.

Market Sentiment and Momentum: Financial markets are influenced by psychological factors, including investor sentiment and market momentum. The rapid sell-off may have been exacerbated by a self-reinforcing cycle of selling, as investors rushed to exit positions in anticipation of further declines.

Implications and Considerations

The unprecedented sell-off in US bonds has several potential implications for various stakeholders:

Investors: Those who hold bonds in their portfolios may experience short-term losses as bond prices decline. This could prompt a reconsideration of portfolio allocations, especially for investors heavily exposed to fixed-income assets.

Borrowing Costs: Rising bond yields can lead to higher borrowing costs for governments, corporations, and individuals. This could impact economic activity, especially in sectors highly reliant on borrowing.

Equity Markets: Bond yields and equity markets are interconnected. Higher bond yields can compete with stocks for investor attention, potentially leading to increased market volatility.

Central Bank Actions: Central banks may need to carefully manage their messaging and actions to prevent excessive market disruptions. Premature or sudden policy changes could intensify the sell-off and negatively affect overall economic stability.

Conclusion

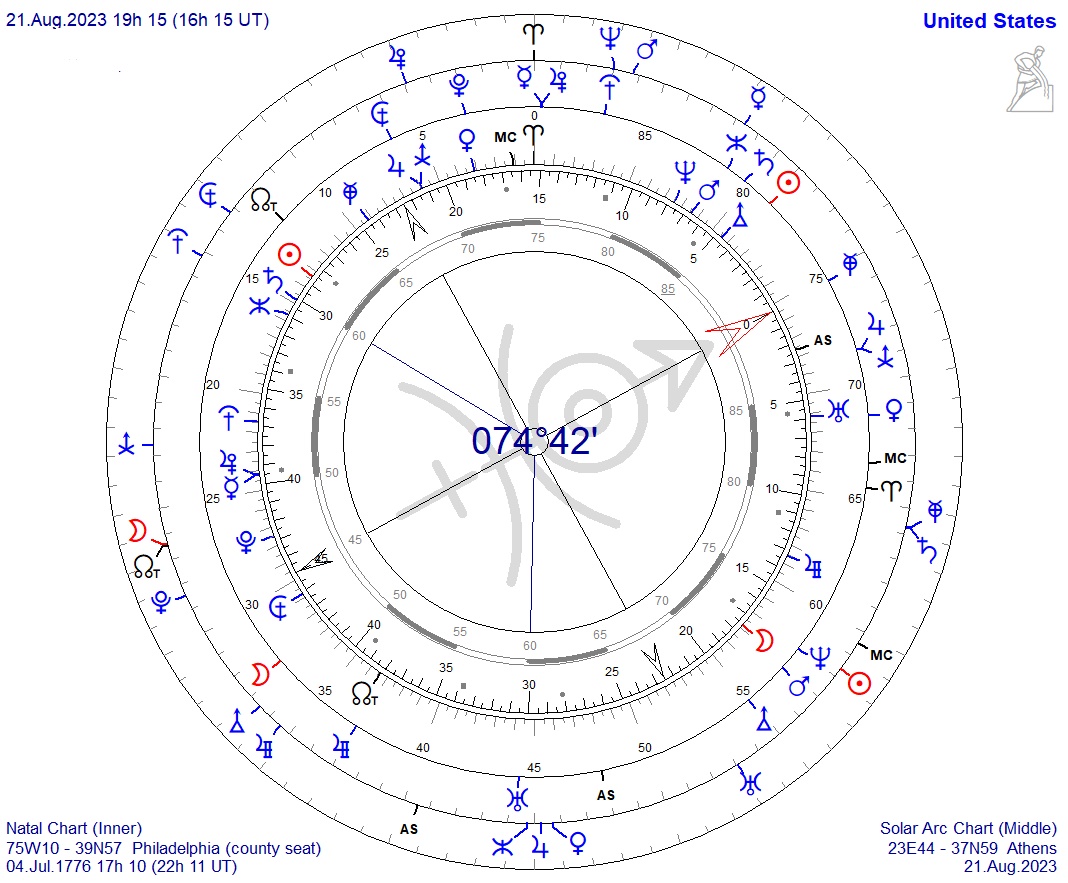

The unprecedented sell-off of US bonds has generated significant interest and concern across financial markets. This event highlights the intricate interplay of factors that influence bond markets and underscores the importance of understanding the dynamics between monetary policy, economic recovery, inflation, and investor sentiment. As central banks navigate the delicate task of balancing economic stability and growth, investors and analysts will be closely monitoring developments to discern the future trajectory of bond markets and their potential ripple effects throughout the global economy. SARC HADES is working corrosively and bringing things exactly as I predicted…. The Annual NEPTUNE is bringing a deconstruction of the US economy to the point where if someone had said it 5 years ago they would have been called at least crazy or just “weird”