“The economy depends about as much on economists as the weather does on weather forecasters.” – Jean-Paul Kauffmann

2023 leaves and leaves behind a deposit so that 2024 becomes generally a waste. The great economists say that markets and money (which moves markets) is psychology. Everyone’s psychology is a complex equation that, at least in my eyes, is: GLOBAL CONDITIONS + LIFESTYLE-COST OF LIFE.

If you look at people, you will find that most people are not optimistic about the future. Especially in the United States but also in Europe & England if you look at the so-called “leaders,” they remind you of the harmony and coordination that the crew of the Titanic had just before it sank in the frozen waters of the ocean. In England, Rishi Sunak replaced Liz Truss, who in turn replaced Boris Johnson, and one wonders what the famous “people’s will” is. A Goldman Sachs man is at the wheel of the country, bypassing the elections, with England in an unprecedented recession. Will this billionaire solve the problems of the British people? The same is the case in France (*but he chooses), in Germany with the Chancellor having the psychology of a tavern owner who closes after 70 years of operation, while in America they have Biden, who holds the fate of a superpower in his hands in his mind, which is a step before the loss of reason.

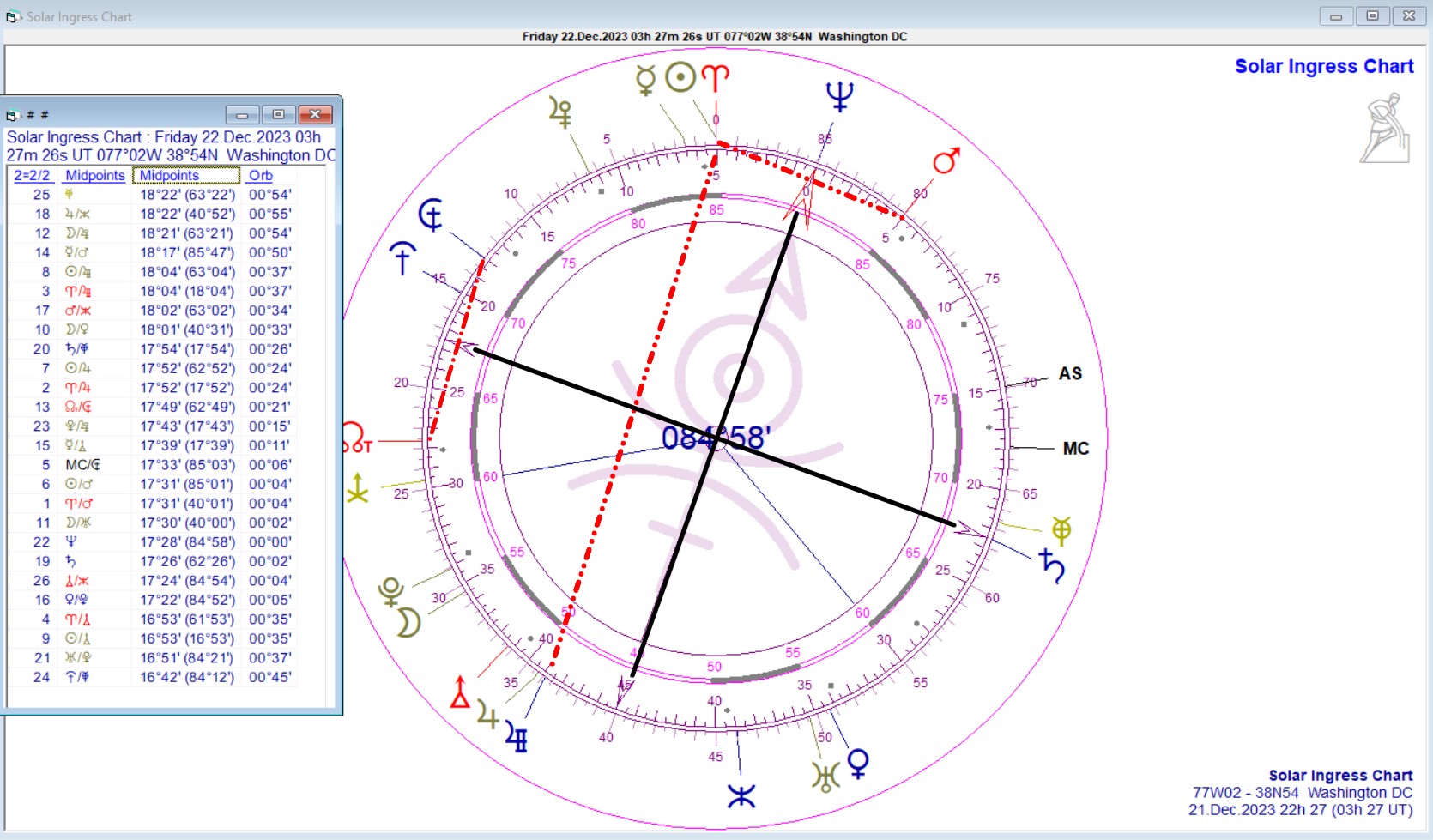

Planetic equations and challenges for the year 2024

Planetic equations and challenges for the year 2024

the year has SATURN equals NEPTUNE and this based on the teachings of Alfred Witte suggests that it is a year full of disease, deception and theft. The involvement, as you can see with the red dotted lines, of the WI/JU, SU /JU, WI/MA, SU/MA & KN/HA axes tell us about:

WI/JU=SA: A hopeless joy through a separation. Luck comes from the trade in fruit and agricultural products in general. Separation – salvation!!!

WI/JU=NE: Feeling lucky and prosperous (utopic). Losses. I believe in my luck.

SO/JU=NE: A successful scammer. Loss of money. The person becomes poor. Unclear terms. Aristocracy. Giving the false impression that he’s working for success.

SO/JU=SA: Loss of position. Missing a chance. Unhindered success. Lost happiness.

WI/MA=SA: Working accident. Death at work. It’s hard work. Stop working. Sick leave.

WI/MA=NE: Working room. It’s a waste of time. Poisoning. A job that “does not pull”.

SO/MA=NE: The powerless husband. Tired. The cheated husband. The loss of the husband. The loss of work. Doing well as I work. A job entirely superficial. The person who will be deceived. Sexually insufficient with problems with erection or ejaculation.

SO/MA=SA: The beginning of a disease. The blocked activity of a person. An interruption of work or other activity.

KN/HA=SA: Loss through a dirty energy. A theft in an already troubled business. Exclusion.

KN/HA=NE: Danger. Drowning. Damage from the water.

BEWARE Bitcoin ETF

ETF stands for Exchange-Traded Fund. It is a type of investment fund and exchange-traded product, with shares that trade on stock exchanges. ETFs are designed to track the performance of a particular index, such as the S&P 500, a commodity, bonds, or a basket of assets like an index fund.

Here are some key characteristics of ETFs:

Here are some key characteristics of ETFs:

Diversification: ETFs typically hold a diversified portfolio of assets, which helps spread risk across different securities.

Liquidity: ETFs trade on stock exchanges like individual stocks, providing liquidity for investors who want to buy or sell shares at market prices during trading hours.

Transparency: The holdings of an ETF are usually disclosed on a daily basis, allowing investors to see exactly what assets are held in the fund.

Low Expense Ratios: ETFs often have lower expense ratios compared to actively managed mutual funds. This is because many ETFs aim to passively track an index rather than having a team of fund managers actively making investment decisions.

Tax Efficiency: ETFs are generally tax-efficient due to their “in-kind” creation and redemption process, which helps minimize capital gains distributions.

Flexibility: Investors can buy and sell ETF shares throughout the trading day at market prices, and they can also use limit orders, stop-loss orders, and other trading strategies.

Wide Range of Asset Classes: ETFs cover a broad range of asset classes, including stocks, bonds, commodities, and real estate, allowing investors to gain exposure to different sectors of the market.

There are also leveraged and inverse ETFs, which aim to magnify the returns of an underlying index or provide inverse returns. However, these types of ETFs come with higher risk and are typically used by more sophisticated investors for short-term trading or hedging purposes.

Investors should carefully consider their investment objectives, risk tolerance, and time horizon before investing in ETFs or any other financial instrument.

As of my last knowledge update in January 2022, there were ongoing discussions and efforts to introduce a Bitcoin Exchange-Traded Fund (ETF) in various financial markets. A Bitcoin ETF would provide investors with a way to gain exposure to Bitcoin without directly owning the cryptocurrency. Instead, investors would buy shares in the ETF, which would hold Bitcoin as part of its underlying assets.

Here are some key points related to Bitcoin ETFs:

SEC Consideration: In the United States, the Securities and Exchange Commission (SEC) has been considering proposals for Bitcoin ETFs. The SEC has expressed concerns about market manipulation, investor protection, and the overall maturity and stability of the cryptocurrency market.

Global Developments: Outside the U.S., several countries have approved or are considering the approval of Bitcoin ETFs. In Canada, for example, Bitcoin ETFs have been launched and have garnered attention from investors.

Market Impact: The introduction of a Bitcoin ETF is expected to have a significant impact on the cryptocurrency market. It could potentially make it easier for institutional and retail investors to invest in Bitcoin, leading to increased demand.

Regulatory Challenges: Regulatory approval is a key challenge for Bitcoin ETFs. Regulators are concerned about the potential for market manipulation, the lack of oversight in the cryptocurrency market, and the need for investor protection.

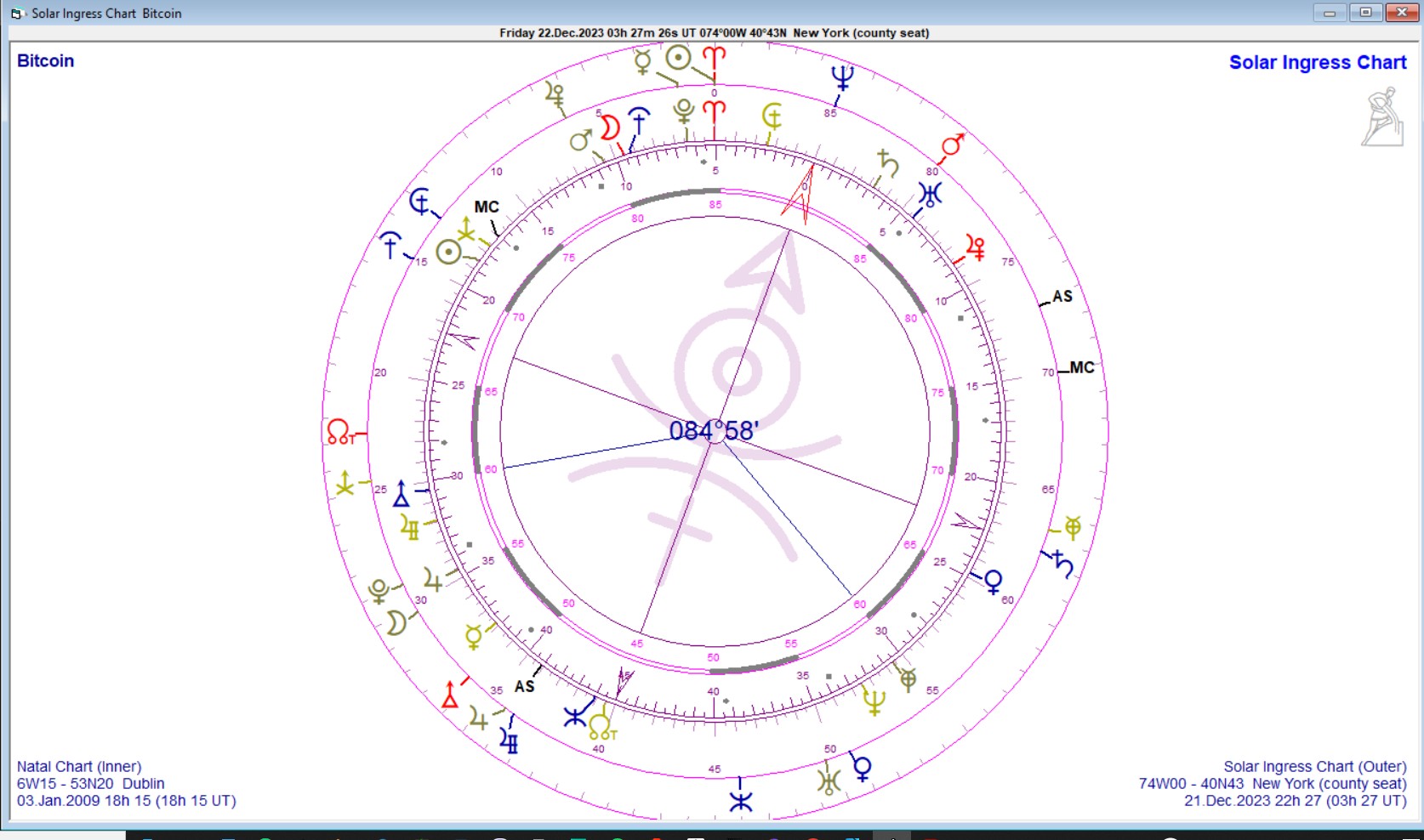

It is necessary to say that there was an attempt with the Bitcoin ETFs in the year 2021 and I had said that it was not a very successful move, The year I started with SATURN & NEPTUNE to equal the North Link of the map of the 1st ETF BITCOIN while simultaneously hitting and the North Band of the BITCoin map and this is interpreted as:

SA=KN: The axis of separation from a karmic perspective. Participating in an event. Separation through alienation. Difficulty with others. Contact with the authorities but also with the elderly.

NE=KN: The axis of secret and hidden relationships and contacts with fraudsters. Karmic dreams – prophetic dreams. Secret contacts. Issues through diseases that cannot be easily diagnosed. Background contacts and consultations.

Conclusion: The rise of Bitcoin is independent of the adoption of Bitcoin ETFs. Instead, maybe ETFs are a Trojan Horse. I hope I’m wrong